Results from an employee housing survey conducted last year show that Colorado State University needs to continue strengthening efforts to make housing more affordable if it wants to recruit and retain high-quality faculty and staff.

The 2021 Employee Housing Needs Assessment, which was conducted at CSU in August and September, showed that 26% of those who declined recent job offers cited housing costs.

The confidential survey, which had a 30% response rate, resulted from the formation of a new Employee Housing Programs unit and housing task force last spring.

Priority for Courageous Strategic Transformation

CSU President Joyce McConnell had emphasized the commitment to helping faculty/staff secure affordable housing during discussions around the Courageous Strategic Transformation plan.

“Our employees go above and beyond for our students and our community every day,” she said. “We are determined to go above and beyond for them as well.”

At least 65% of survey respondents said implementing university-assisted housing programs is likely to help attract employees to CSU and would encourage them and other employees to stay at the University.

“What surprised me was the magnitude,” said Brett Anderson, special assistant to CSU System Chancellor Tony Frank. “It’s not just 5% or 10%. A large percentage of the entire employee base is saying that housing is becoming a real challenge.”

Primary themes

Debbie Mayer, Employee Housing Programs coordinator, said that she sees four main themes in the survey results:

- Affordable housing is crucial to recruitment and retention.

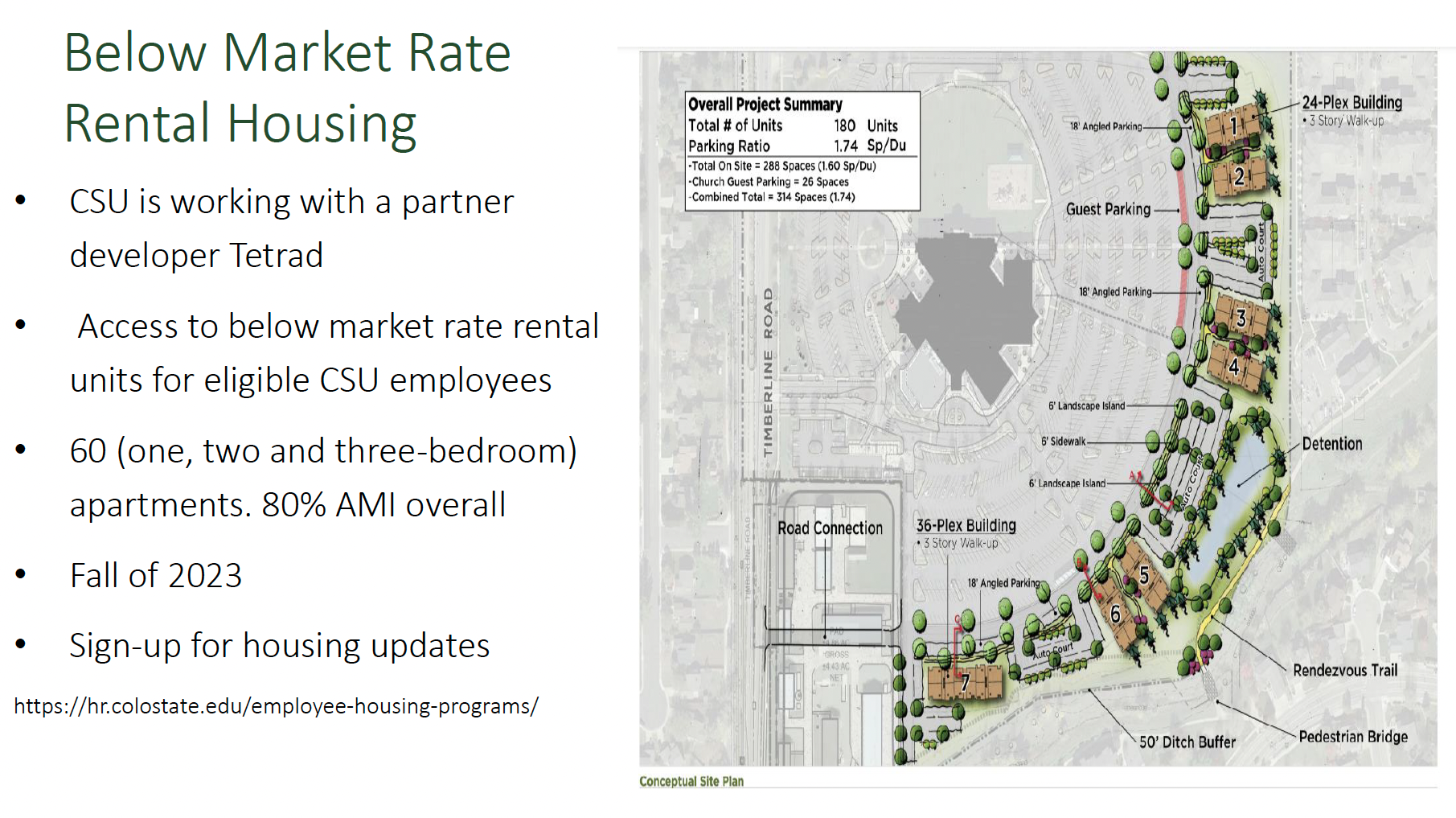

- There is excess demand to fill the 60 affordable units set aside for CSU employees at the housing development proposed near Timberline Church — even more housing stock is needed.

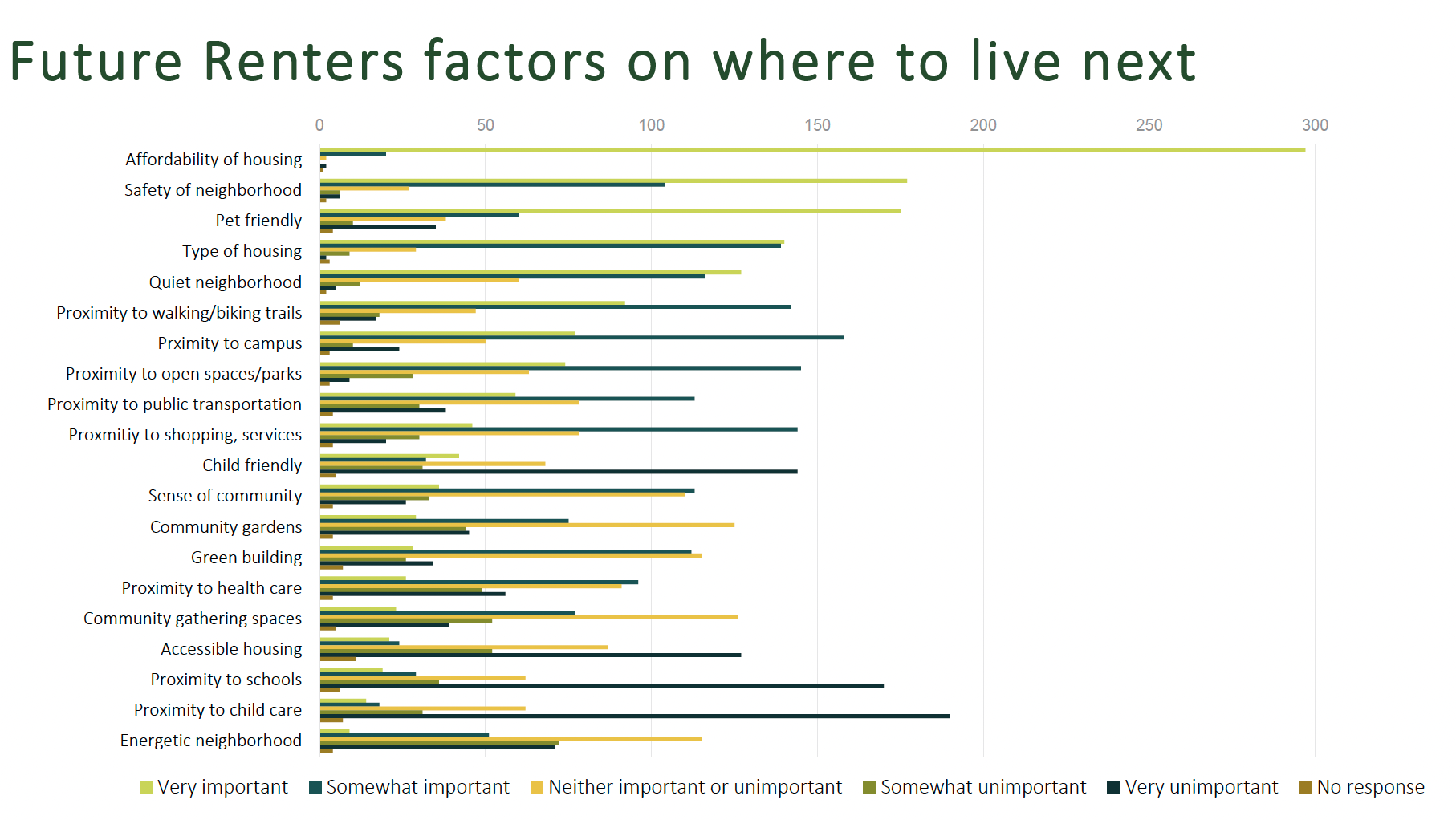

- Renters have a heavy cost burden and report a strong need and interest in assistance with their first/last month’s rent or security deposit, over other types of assistance.

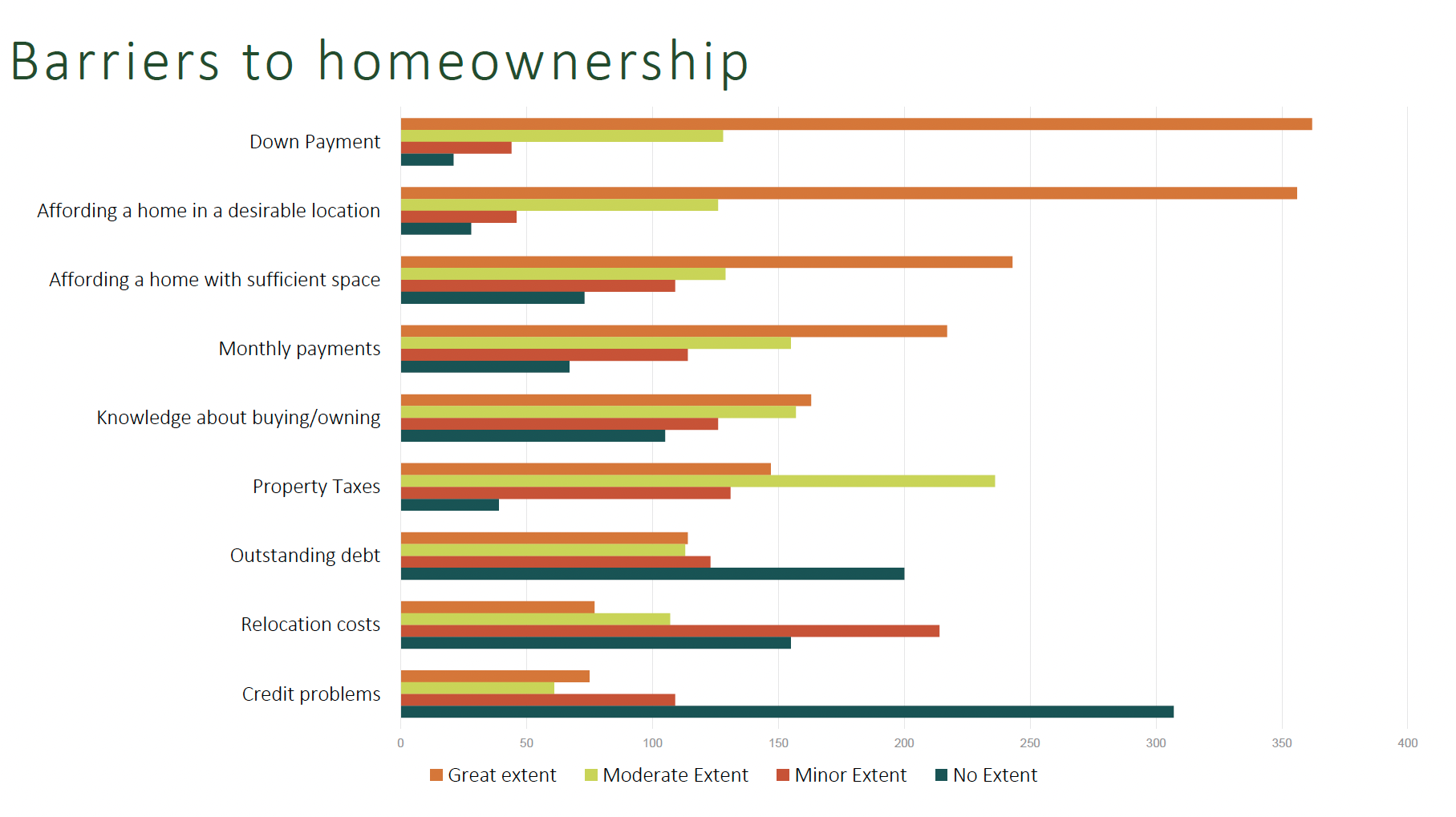

- 70% of renters said homeownership is very important or extremely important, but cost was seen as the top deterrent (affording a down payment was the number one concern). About 59% said owning a home is definitely or probably a critical consideration in continuing to work at CSU.

Mayer said Larimer County has seen a 45% increase in average rent over the past decade. And as of 2020, the median home sale value was $417,000 in Larimer County overall and $429,000 in unincorporated areas, reflecting about a 70% increase over 2010 values.

“How do you keep up with that?” she asked.

Multipronged effort

Anderson explained that there are many approaches being explored and pursued, and it will require a multifaceted approach to improve the situation.

“After seeing the survey results, we realized there is a broad and diverse set of needs,” he said. “There’s not one specific thing, such as not having enough rental apartments or enough units for sale. It’s a broad issue with our employee base. It’s going to take a lot of initiatives, with Timberline being just one. It’s also going to take time, so we’re going to have to be a little patient, but we need our employees to know we’re working on it.”

The first, and perhaps the easiest, step has already been taken. An Employee Housing Programs website serves as a one-stop shop for resources around affordable housing. In addition to materials on rental housing, home ownership, moving/relocation, financial assistance and other types of support, employees can sign up to receive email updates on housing-related programs, events and other opportunities.

The slide above shows details about the Timberline development proposal.

Possible options

Some of the other possible programs under consideration include:

- Partnerships with real estate professionals to offer CSU employees benefits such as commission rebates, discounted inspections or waived application fees.

- Discounted mortgage rates or waivers on mortgage insurance from lenders. One option is for CSU to serve as a guarantor on loans for employees who don’t have the required 20% down payment. (Canvas Credit Union already offers mortgage discounts to CSU employees.)

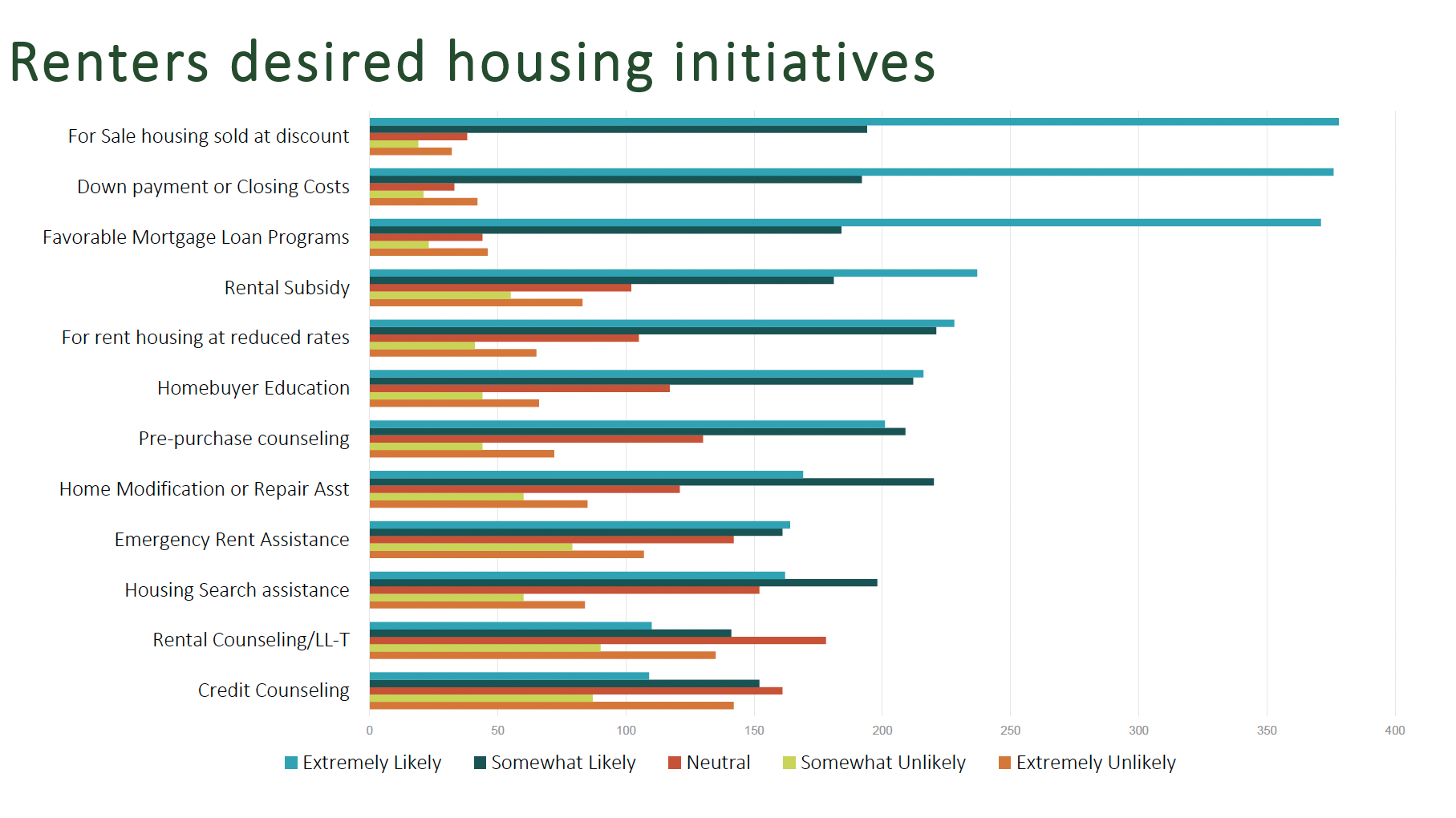

- Matched savings account programs in which CSU would seek grant money to match employee contributions, up to a set amount and for a specific purpose. It would also involve homebuyer education like pre-purchase counseling.

“These are just the initial programs we are considering,” Anderson said. “Not all are going to be the right solution right off the bat, so we are committed to a long-term and comprehensive approach to address the housing needs and challenges of our employees.”

“Affordable housing is a wellbeing issue,” Mayer said when the survey was launched last year. “For some of our employees, rent is 50% of their income, and it can be so stressful when you are worrying about how to pay rent, buy food and support children. But it also is a recruitment and a retention issue. We want to attract the best employees and keep our quality faculty and staff members.”