Colorado State University is increasing the amount it pays into each employee’s health insurance benefits to offset increased costs to the employee, contributing additional money beyond its regular annual increase for health insurance to keep employees from paying significantly more.

In 2022, CSU paid $50.3 million to fund employee health insurance costs. In 2023, CSU will fund its regular increase plus an extra $3.3 million, for a total of $55.4 million toward employee health insurance coverage.

This equals a CSU contribution of $10,600 each year for each employee, up from $9,778 per employee last year for medical coverage, with employees covering the rest.

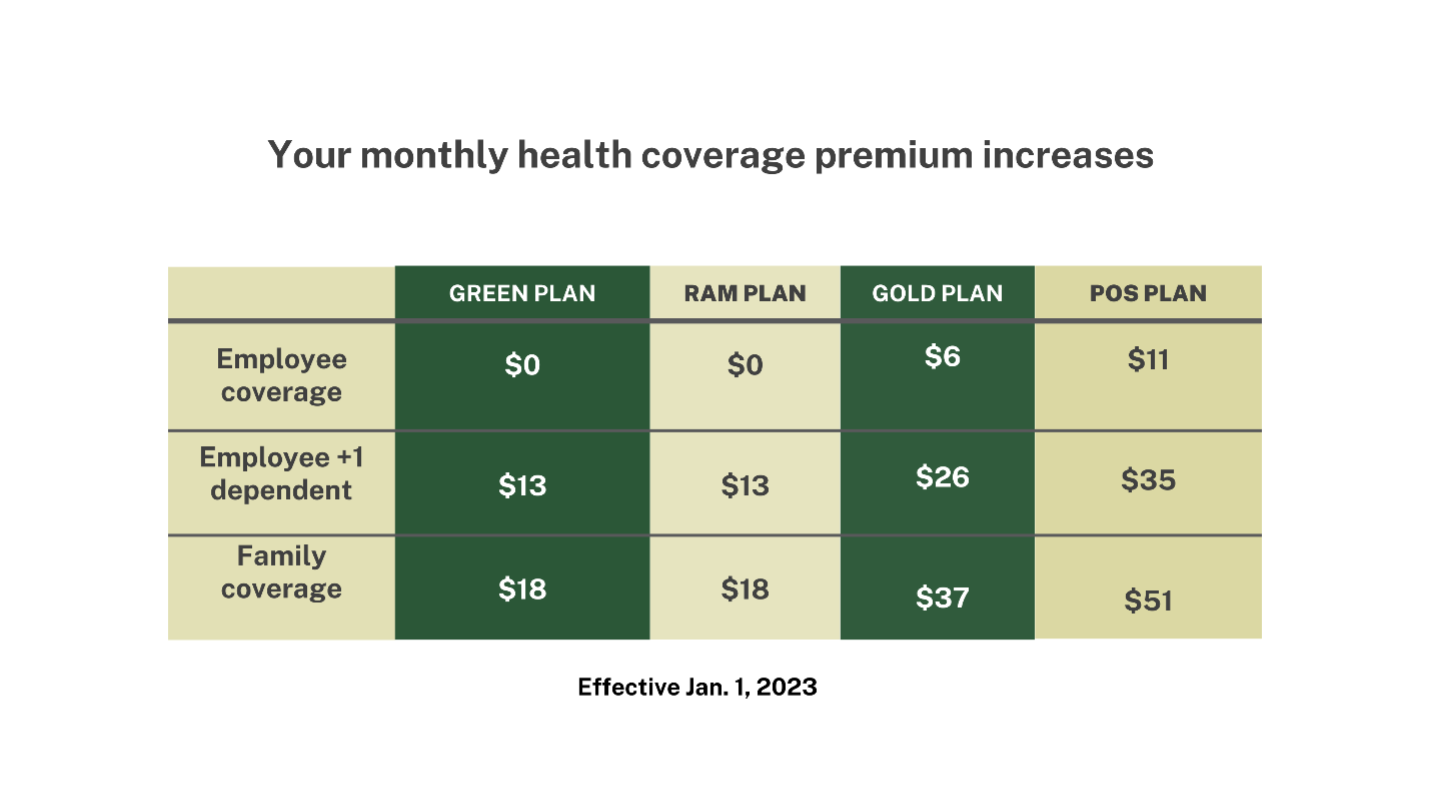

Employees enrolled in some health insurance plans will see an increase in their monthly premiums. Employees on the Ram Plan or Green Plan who do not provide coverage for dependents will not see an increase in their monthly premium cost.

Why insurance premiums on some plans are increasing

The university is self-insured, which means that insurance claims from employees drive health insurance premiums that employees pay. During 2022, there has been a high dollar amount of claims submitted, in part due to COVID and the resulting impact of delayed care.

This has created a need for health insurance plan premiums to increase so that the collective cost of providing health insurance for employees can be balanced.

As a result, some employees will see slightly higher insurance premiums withdrawn from their pay each month. There are no increases in monthly premiums for dental, voluntary life insurance, short-term and long-term disability insurance or vision coverage.

Once-a-year opportunity to change benefits starts Oct. 31

Open enrollment for faculty and administrative professionals begins on Monday, Oct. 31 and ends Friday, Nov. 18. This is the once-a-year opportunity to modify CSU benefits for the next calendar year, barring a qualifying event such as the birth of a child. So faculty and staff who want to make a change to their medical coverage plans should do so during open enrollment.

Open enrollment is the time for employees to change:

- Their medical insurance plan, along with vision and dental plan options.

- Their covered dependents, such as adding or removing a spouse, domestic partner or children.

- Which company keeps records of their mandatory defined contribution plan retirement contributions (changes cannot be made to PERA).

- Their health savings account and flexible savings account options.

- The amount of voluntary life coverage carried for the employee and their spouse or partner.

If employees do not make changes to their benefits, they will stay the same, with the exception of flexible spending accounts. Those enrolled in a flexible health spending account are required to re-enroll each year.

There are no other significant changes to health insurance coverage options this year.

Changes made during open enrollment become effective Jan. 1. Changes to health plans outside of open enrollment dates are allowed only for specific circumstances that include births, adoption, changes to marital, domestic partnership or civil union status, and similar events.

Employees can view and change their current health insurance and the records for their retirement account, vision, dental and other options by visiting employee self-service at aar.is.colostate.edu. They must submit official documentation for any new dependents they add to their insurance to Human Resources by 4:30 p.m. on Friday, Nov. 18.

“Updates to medical plans include a specific list of no-cost preventive prescriptions and access to an inclusive care concierge service that helps you find and access medical providers and care more easily with an Anthem health guide. The team also specializes in inclusive LGBTQ+ care,” said Teri Suhr, chief total rewards officer. “Human Resources has sharpened its focus on amplifying resources that help enhance our employee well-being and offering a rich benefits package.”

CSU will continue to pay 100% of the cost of coverage for employees enrolled in the Green or Ram health insurance coverage, basic life and short-term disability coverage. Employees are required to pay premiums for dependents who enroll in these health insurance plans.

Answers to questions about benefit choices

Need help understanding open enrollment options?

- In person with Human Resources and benefits providers.

If you have questions about CSU benefits, you can speak with the Human Resources benefits team and with companies such as Anthem and Delta Dental that provide benefits at the annual benefits fair, 10 a.m. – 1 p.m., Wednesday, Nov. 9, at the Lory Student Center, Ballroom B. You can also grab snacks, freebies and enter to win prizes.

- Virtual with a Human Resources team member.

Visit with Human Resources virtually via Teams, 11 a.m. to 1 p.m., Tuesdays and Wednesdays. Register for a personal, 15-minute appointment on the open enrollment website to ask questions or receive enrollment assistance.

How much should you contribute to a health savings account or flexible spending account?

CSU has an online tool called ALEX that helps employees learn about benefit options. This tool can also help you decide how much to put into your health savings account or flexible spending account – and which other health and retirement benefits might be a good fit for you.

Visit the ALEX homepage to use the tool.

New, year-long health and well-being resources

Anthem Health Guide and inclusive care

Beginning in 2023, you can access a team of customer service experts to:

- Connect you with support regarding medical and prescription drug coverage

- Provide an inclusive and a total health approach – defined as a comprehensive, coordinated approach to care for LGBTQ+ individuals

- Stay on top of exams and screenings by providing reminders to make appointments – or, if you want, they can even help you make an appointment

- Access a network of centers of excellence for specialized health-care needs

- Compare costs for health-care services, find in-network doctors and much more

These guides are offered by Anthem and are trained on all aspects of your health benefits, providers and programs to serve the entire CSU population for excellence in inclusive care.

Check out this video to learn more.

No-cost preventive medications

Employees will now have access to select preventive medications to help them manage health conditions. Medications on this list will be provided with no-cost prescriptions under a program called PreventiveRx.

This program covers medicines that may keep you healthy because they may prevent illness and other health conditions. You can get specified medicines on the PreventiveRx list – generally generic medications as alternatives to brand name drugs – at no-cost.

This new medical benefit starts Jan. 1 and aims to help employees manage common, chronic medical conditions such as high blood pressure, high cholesterol, diabetes and asthma.

Employee Assistance Program

Starting Jan. 1, employees can access a well-being coach through the Employee Assistance Program. The coach offers one-on-one support through a video session or on the phone. The coaches, who are available through ComPsych, are specialists who work with you to reduce personal roadblocks and specific risks, such as mental health and well-being issues, before they evolve into long-term, more costly challenges.

The Employee Assistance Program has also added WellthSource, an online platform where you can access personalized financial well-being information and tips after taking an assessment to set financial goals for your personal needs, career and future retirement. The platform is available Jan.1.

Earn a wellness incentive

Employees enrolled in an Anthem medical plan can earn a $150 wellness incentive when they participate in the fall health fair blood draw, check in with their retirement counselor or attend a webinar, complete at YOU@CSU self-check, and complete Anthem’s health assessment. Employees who complete these options by Dec. 31 will earn $150 (taxable) which will be included with a spring 2023 paycheck. When you complete these options, submit this FITlife wellness incentive form to Human Resources.