Colorado State University is launching its own version of a new state program for family and medical leave called FAMLI.

FAMLI stands for the Family and Medical Leave Insurance Program, and it was approved by voters in 2020 as Proposition 118. CSU was required to implement a payroll deduction on each employee’s wages to fund half of the new leave program, and the university funds the other half.

State employers implemented a payroll tax of 0.45% on each employee’s wages last January to fund the new paid leave. CSU paid both the employee’s portion and the university’s portion of the premium deduction through June 30.

About the CSU plan

FAMLI allows employers to substitute a private self-funded plan that offers the same benefits and protections, and the state has approved CSU’s operation of its own FAMLI plan through Human Resources. CSU employees should not turn to the state’s FAMLI program for assistance, but to the University’s HR division instead.

All CSU employees who work and live in Colorado are eligible for the program, which has similar but not identical qualifying reasons as the Family and Medical Leave Act, or FMLA. Income replacement under FAMLI is not 100% of an employee’s salary, but other leave-related programs can supplement what FAMLI provides, “topping off” the FAMLI wage reimbursement if eligible. FAMLI leave must be used before other leave program options and runs concurrently with FMLA.

Qualifying reasons for leave

Beginning in January, eligible employees may apply for up to 12 weeks of paid FAMLI leave for eligible qualifying reasons, and an additional four weeks is available for pregnancy complications. Qualifying reasons include:

- Care for their own serious health condition

- Care for a family member’s serious health condition

- Care for a new child, including adopted and fostered children

- Arranging for a family member’s military deployment

- Addressing immediate safety needs and impact of domestic violence or sexual assault

FAMLI leave claims must be applied for within 30 days of the first date of absence. Job protection is also offered through FAMLI for those who have more than 180 days of employment.

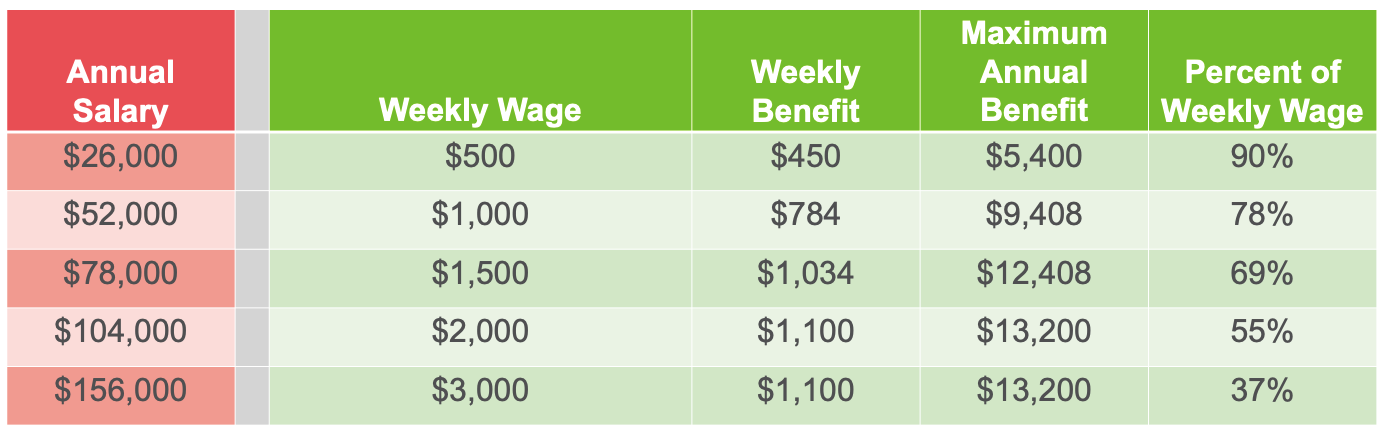

Benefits are calculated on a sliding scale, up to a weekly maximum benefit currently set at $1,100. The monetary calculation for FAMLI uses a base period of the first four of the last five completed calendar quarters immediately preceding the first day of the employee’s benefit year, in relation to the average weekly wage for the State of Colorado. As of July 2023, the State’s average weekly wage was $1,421.16 and is subject to change annually.

The weekly benefit is 90% of an employee’s average weekly wage, if it is equal to or less than 50% of the state’s average weekly wage ($710.58). Then, for any portion of the employee’s wage greater than 50% of the state’s average weekly wage, the calculation is 50% of the employee’s remaining average weekly wage, up to the $1,100 weekly maximum.

Additional resources

Virtual and in-person learning sessions for HR partners, as well as webinars for employees to learn about the program benefits, will be offered in January by Human Resources, the administrator for CSU’s own university FAMLI private plan.

A summary of CSU’s FAMLI plan can be found on the Human Resources website as well as specific required notices in English and Spanish.

The state’s FAMLI website includes a calculator to help you determine how much you would pay for FAMLI if the university did not contribute its portion. Human Resources is also available to answer questions via email or at 970-491-6947.