Tag: "Department of Accounting"

More from this site

Crowley County: Chelsea Powell – Business Administration/Accounting

During the 2022-23 academic year, we are highlighting one Colorado State University student or alum from each of Colorado's 64 counties. The Centennial State's land grant university has a connection to the diverse lands and people from the counties of Moffat to Baca, Montezuma to Sedgwick and everywhere in between.

Video: Provost’s Ethics Colloquium explores ethics of artificial intelligence

Privacy. Surveillance. Influence. Medical expert Matthew DeCamp and Colorado State University faculty explored the constellation of issues surrounding artificial intelligence during the annual Provost’s Ethics Colloquium this week.

It’s about the students: Margarita Lenk receives prestigious award for undergraduate instruction

Students, colleagues, and friends share why Margarita Lenk is an award-winning professor in the College of Business.

Free tax help available on Saturdays in Rockwell Hall

Department of Accounting students and tax professionals in the community will be providing free tax return preparation for individuals (no international returns) on Saturdays in Rockwell Hall beginning Feb. 9, from 11 a.m. to 3 p.m.

Classified Personnel Council announces Everyday Hero Award recipients

The Classified Personnel Council is pleased to announce the latest round of Everyday Hero Award recipients.

AARP Tax-Aide program available on campus this spring

The Department of Accounting in the College of Business is partnering with AARP Tax-Aide to offer individual tax return assistance to the CSU and Fort Collins community this spring.

Faculty Focus: Jim Stekelberg

[caption id="attachment_57938" align="alignleft" width="200"] Jim Stekelberg, Assistant Professor, Department of Accounting[/caption]

Jim Stekelberg joined the Department of Accounting in January 2017. Prior to making his move to Colorado, he completed his Ph.D. in accounting at the University of Southern California and taught at the University of Arizona for four years.

Stekelberg says he stumbled into teaching tax “completely by accident.” He first majored in history and music as an undergrad. “Then I realized jobs were tough to come by,” he says. “But I lived near USC, and when I discovered they offered a one-year Master’s program in tax, I thought I’d give it a try.” He had previously considered going to law school, but found the shorter, intensive focus on one area of the law appealing.

“It wasn’t the most well thought-out decision,” he laughs. But now, he says he’s glad he made the switch. In addition to teaching, Stekelberg conducts research into topics that affect tax policy – and finds himself drawn to issues that go beyond purely academic concepts. His most recent paper relates to the ramifications of state tax haven legislation, and can be read here.

Moving to CSU

While Stekelberg was teaching in Arizona, a doctoral student there, James Brushwood, graduated and took a position at Colorado State University. Professor Brushwood spoke very highly of CSU and life in Fort Collins, and when a position for a tax professor opened at the University, Stekelberg says he was immediately interested.

He was drawn to Colorado, in part because it’s an unexplored area for him. Having visited the state only briefly before, he had never had the chance to spend time in Fort Collins. Now that he’s here, he’s looking forward to enjoying the outdoors. He loves hiking, backpacking, and rafting – and is also starting to take up snowshoeing.

As for his time on campus, Stekelberg is enjoying the CSU community. “The students here are excellent,” he says, adding, “We’ve got an excellent department of brilliant yet down-to-earth faculty, and students that are engaged and highly motivated.”

Jim Stekelberg, Assistant Professor, Department of Accounting[/caption]

Jim Stekelberg joined the Department of Accounting in January 2017. Prior to making his move to Colorado, he completed his Ph.D. in accounting at the University of Southern California and taught at the University of Arizona for four years.

Stekelberg says he stumbled into teaching tax “completely by accident.” He first majored in history and music as an undergrad. “Then I realized jobs were tough to come by,” he says. “But I lived near USC, and when I discovered they offered a one-year Master’s program in tax, I thought I’d give it a try.” He had previously considered going to law school, but found the shorter, intensive focus on one area of the law appealing.

“It wasn’t the most well thought-out decision,” he laughs. But now, he says he’s glad he made the switch. In addition to teaching, Stekelberg conducts research into topics that affect tax policy – and finds himself drawn to issues that go beyond purely academic concepts. His most recent paper relates to the ramifications of state tax haven legislation, and can be read here.

Moving to CSU

While Stekelberg was teaching in Arizona, a doctoral student there, James Brushwood, graduated and took a position at Colorado State University. Professor Brushwood spoke very highly of CSU and life in Fort Collins, and when a position for a tax professor opened at the University, Stekelberg says he was immediately interested.

He was drawn to Colorado, in part because it’s an unexplored area for him. Having visited the state only briefly before, he had never had the chance to spend time in Fort Collins. Now that he’s here, he’s looking forward to enjoying the outdoors. He loves hiking, backpacking, and rafting – and is also starting to take up snowshoeing.

As for his time on campus, Stekelberg is enjoying the CSU community. “The students here are excellent,” he says, adding, “We’ve got an excellent department of brilliant yet down-to-earth faculty, and students that are engaged and highly motivated.”

Faculty Focus: Margarita Lenk – Semester at Sea

[caption id="attachment_57945" align="alignnone" width="870"] In Greece, students worked on case analysis in the open air of Pnyka, and presented their ideas in the same place where the world’s first outdoor democratic congress took place — in view of the Acropolis and the Temple of Athena.[/caption]

Ahh… a study-abroad trip with classes set both on a cruise ship and on land in some of the world’s most famous and most beautiful locations. Sounds like a dream come true — and it is — but it’s also incredibly hard work.

Associate Professor of Accounting Margarita Lenk spent 18 months preparing to teach as a faculty member for her recent Semester at Sea. “That was intense,” she says. “Finding all the data required to explain how accounting, entrepreneurism and business ethics work in so many different countries.”

The Fall 2016 voyage took about 560 student participants from 70 countries, to visit nations all over the world. The itinerary included Germany, Greece, Italy, Spain, Morocco, Senegal, Brazil, Trinidad, Peru, and Ecuador – taking the group across the Atlantic ocean (during the U.S. presidential election), and through the Panama Canal.

Lenk taught courses in Financial Accounting, Entrepreneurship, and Business Ethics. And each class session featured direct ties, from lecture content to the country the students were about to visit.

The experience was both incredibly challenging and endlessly fascinating, for teachers and students alike. “Every day on the ship, there was intensive teaching from 7 a.m. to 10 p.m.,” she says. “These classes are deeply integrated, and faculty are very intertwined with student life. So from a teaching perspective, it’s for professors who really enjoy that type of intensity.”

“Lifelong Learners” also joined in on the trip. These individuals use Semester at Sea programs as their own opportunities to travel, while giving back through guest lectures. On Lenk’s trip, these Lifelong Learners included Conrad Hermann (an investment banker from Silicon Valley), and Elaine Church, a retired PwC partner from Washington D.C., who worked on the U.S. Congress committee to create pension legislation.

Learning in Trinidad

On land, students had 5 days at each port, with on-site excursions led by the professors. Lenk herself led dozens of these excursions.

In Trinidad, for instance, she took her students to the Arthur Lok Jack Graduate School for an accounting class and lecture from a top economist based there. “He explained to us,” she notes, “that the GDP in Trinidad is 300 percent higher than in other Caribbean islands, due to the fact that they have oil reserves there. However, they have recently learned that these reserves will only last ten more years.” So the students got to learn about, and discuss potential solutions to making up for the future loss of this valuable resource.

In addition, her class heard from the head of the nation’s accounting regulation board. “He talked to us about why they have adopted accounting standards there,” says Lenk. “And we also heard from a local sociologist who explained the ramifications on the people who live and work there.”

Students were then taken for a visit to the local KPMG office in Trinidad. “They gave us a four-hour presentation on professionalism, and it was very powerful,” she notes. “We were so honored that KPMG took the time to work with us there.”

Other Rich, Hands-On Learning Opportunities

Every port provided similar educational opportunities. Lenk says the Semester at Sea program currently has relationships built with 250 universities — so students are able to meet with important scholars and business people, everywhere they go.

In Greece, their Business Ethics field class took them to the ALBA Graduate Business School where the met with a top agricultural economist, Maria Ines Carpi. There, they learned about the country’s approach to issues of land and water use, pesticides, GMOs, the Russian embargo, and the growing popularity of fake “Greek” products (like yogurt).

In Morocco, students took on the role of advisors, helping six startup businesses prepare for their appearance at the International Renewable and Sustainable Energy Conference in Marrakech. “With the consultation,” Lenk says, “these entrepreneurs were completely prepared in all areas of business development: financial risk, operations, and more.”

Lessons for Life

For Lenk, other instructors, and hundreds of students, the Semester at Sea provided an unmatched learning and teaching opportunity. “The globalization of content, flipping the classroom, and the level of student engagement are things I’ll bring with me as I continue teaching at CSU,” says Lenk, noting that the insights she gained have given her ideas for new research as well.

Once she returned, she said, “It was really good to be home. It’s a long time to be away, and I’m always grateful to return to CSU.”

Some of the Sights from Semester at Sea

The Semester at Sea is all about having an intensive, immersive learning opportunity that offers students and unmatched opportunities to learn about the global economy. During the Fall 2016 semester, about 20 CSU students joined Lenk for the trip. Along the way, the group was able to see many world-famous sights. Here are just a few:

In Greece, students worked on case analysis in the open air of Pnyka, and presented their ideas in the same place where the world’s first outdoor democratic congress took place — in view of the Acropolis and the Temple of Athena.[/caption]

Ahh… a study-abroad trip with classes set both on a cruise ship and on land in some of the world’s most famous and most beautiful locations. Sounds like a dream come true — and it is — but it’s also incredibly hard work.

Associate Professor of Accounting Margarita Lenk spent 18 months preparing to teach as a faculty member for her recent Semester at Sea. “That was intense,” she says. “Finding all the data required to explain how accounting, entrepreneurism and business ethics work in so many different countries.”

The Fall 2016 voyage took about 560 student participants from 70 countries, to visit nations all over the world. The itinerary included Germany, Greece, Italy, Spain, Morocco, Senegal, Brazil, Trinidad, Peru, and Ecuador – taking the group across the Atlantic ocean (during the U.S. presidential election), and through the Panama Canal.

Lenk taught courses in Financial Accounting, Entrepreneurship, and Business Ethics. And each class session featured direct ties, from lecture content to the country the students were about to visit.

The experience was both incredibly challenging and endlessly fascinating, for teachers and students alike. “Every day on the ship, there was intensive teaching from 7 a.m. to 10 p.m.,” she says. “These classes are deeply integrated, and faculty are very intertwined with student life. So from a teaching perspective, it’s for professors who really enjoy that type of intensity.”

“Lifelong Learners” also joined in on the trip. These individuals use Semester at Sea programs as their own opportunities to travel, while giving back through guest lectures. On Lenk’s trip, these Lifelong Learners included Conrad Hermann (an investment banker from Silicon Valley), and Elaine Church, a retired PwC partner from Washington D.C., who worked on the U.S. Congress committee to create pension legislation.

Learning in Trinidad

On land, students had 5 days at each port, with on-site excursions led by the professors. Lenk herself led dozens of these excursions.

In Trinidad, for instance, she took her students to the Arthur Lok Jack Graduate School for an accounting class and lecture from a top economist based there. “He explained to us,” she notes, “that the GDP in Trinidad is 300 percent higher than in other Caribbean islands, due to the fact that they have oil reserves there. However, they have recently learned that these reserves will only last ten more years.” So the students got to learn about, and discuss potential solutions to making up for the future loss of this valuable resource.

In addition, her class heard from the head of the nation’s accounting regulation board. “He talked to us about why they have adopted accounting standards there,” says Lenk. “And we also heard from a local sociologist who explained the ramifications on the people who live and work there.”

Students were then taken for a visit to the local KPMG office in Trinidad. “They gave us a four-hour presentation on professionalism, and it was very powerful,” she notes. “We were so honored that KPMG took the time to work with us there.”

Other Rich, Hands-On Learning Opportunities

Every port provided similar educational opportunities. Lenk says the Semester at Sea program currently has relationships built with 250 universities — so students are able to meet with important scholars and business people, everywhere they go.

In Greece, their Business Ethics field class took them to the ALBA Graduate Business School where the met with a top agricultural economist, Maria Ines Carpi. There, they learned about the country’s approach to issues of land and water use, pesticides, GMOs, the Russian embargo, and the growing popularity of fake “Greek” products (like yogurt).

In Morocco, students took on the role of advisors, helping six startup businesses prepare for their appearance at the International Renewable and Sustainable Energy Conference in Marrakech. “With the consultation,” Lenk says, “these entrepreneurs were completely prepared in all areas of business development: financial risk, operations, and more.”

Lessons for Life

For Lenk, other instructors, and hundreds of students, the Semester at Sea provided an unmatched learning and teaching opportunity. “The globalization of content, flipping the classroom, and the level of student engagement are things I’ll bring with me as I continue teaching at CSU,” says Lenk, noting that the insights she gained have given her ideas for new research as well.

Once she returned, she said, “It was really good to be home. It’s a long time to be away, and I’m always grateful to return to CSU.”

Some of the Sights from Semester at Sea

The Semester at Sea is all about having an intensive, immersive learning opportunity that offers students and unmatched opportunities to learn about the global economy. During the Fall 2016 semester, about 20 CSU students joined Lenk for the trip. Along the way, the group was able to see many world-famous sights. Here are just a few:

- Greek islands and ruins

- La Sagrada Familia Cathedral and other Gaudi architecture in Spain

- Rick’s Café in Casablanca

- The Atlas Mountains

- Machu Picchu, Peru

- Galapagos Islands

- Iguazu Falls and the Amazon River in Brazil

- Playa Santa Teresa in Costa Rica

Program Focus: Etiquette Dinner

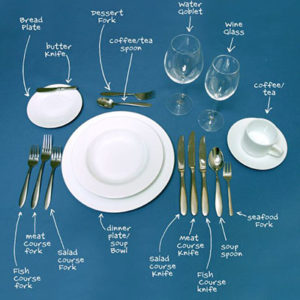

Say you’ve starting interviewing for your first career job, and you’re on your third interview for an opportunity to work with a highly reputable accounting firm. You’re invited to join high-ranking representatives for a formal dinner at an elegant restaurant. When you arrive, the table is set for a five-course meal, with more glasses, silverware, and plates than you’ve ever seen in your life. What do you do?

Without the proper training, etiquette educator Marie Hornback says, you might have to follow others’ lead. Her goal is to train young people in the proper handling of such situations, so that they can demonstrate their own confidence and leadership — and improve their chances of landing the job.

That’s the reason for the etiquette dinner that was recently offered for Department of Accounting students. Hornback specializes in training others in skills of a bygone era — everything from calligraphy and cursive writing for young kids, to formal dining etiquette for college students.

At the February 8 dinner, led by Hornback, students came to a five-course meal featuring shrimp cocktail, soup, salad, main course, and dessert. “What I do,” she says, “is walk them through how to eat that shrimp cocktail — what to do, and what utensils to use, then how to eat soup correctly, and so on. In fact, we cover everything from how to take their seat, and how to place their napkins on their laps, through to placing the napkin back on the table at the end of the meal.”

Why etiquette?

Kathie Schultz, a 1978 CSU graduate who spent time working in public accounting, helped fund the etiquette dinner. She wanted to give back, her employer wanted to match her personal donation to the Department of Accounting, and she wanted to find a unique way to contribute to today’s students.

During her time at CSU, she says, she got to participate in an accounting banquet with some similar elements. “Even if there were just a few tips here and there,” Schultz says, “each thing I learned was one less thing I had to worry about when I later went into business dinners. I was much more at ease, and knew how to make others feel at ease, too. So I could concentrate on whatever business we needed to talk about.”

Hornback’s training gives students the ability to understand how to confidently navigate not just a five-course dinner, but anything from a casual dining setting, to a 14-course meal in Japan.

Carli Judson, a junior double-majoring in accounting and finance, said she was very grateful for the opportunity. “I learned so much,” she says, “including the order in which drinks are served, and in what glasses; how to politely refuse drinks; what each utensil is for; and how to politely eat a roll — which is way more complicated than you’d think! It was very important to learn all these things while doing them. I don't think I could have effectively understood or remembered most things otherwise.”

Schultz hopes the dinners can continue in future years, she says. “I’m a very lucky girl to have gone to school at CSU… I can’t thank Audrey Gramling enough for being so open to discussing different ideas for things people want to do for those studying there today. It really makes you want to stand up and pay it forward.”

Etiquette Tip for Used Silverware

Marie Hornback says you should never put used silverware back on the table between courses, if servers don’t remove them with your dishes. Not so much because it would bother anyone else — but because you won’t want to use the silverware again if you do let it touch the table. If your main plate is gone and you’re waiting for your next course, here are some polite and sanitary options:

Say you’ve starting interviewing for your first career job, and you’re on your third interview for an opportunity to work with a highly reputable accounting firm. You’re invited to join high-ranking representatives for a formal dinner at an elegant restaurant. When you arrive, the table is set for a five-course meal, with more glasses, silverware, and plates than you’ve ever seen in your life. What do you do?

Without the proper training, etiquette educator Marie Hornback says, you might have to follow others’ lead. Her goal is to train young people in the proper handling of such situations, so that they can demonstrate their own confidence and leadership — and improve their chances of landing the job.

That’s the reason for the etiquette dinner that was recently offered for Department of Accounting students. Hornback specializes in training others in skills of a bygone era — everything from calligraphy and cursive writing for young kids, to formal dining etiquette for college students.

At the February 8 dinner, led by Hornback, students came to a five-course meal featuring shrimp cocktail, soup, salad, main course, and dessert. “What I do,” she says, “is walk them through how to eat that shrimp cocktail — what to do, and what utensils to use, then how to eat soup correctly, and so on. In fact, we cover everything from how to take their seat, and how to place their napkins on their laps, through to placing the napkin back on the table at the end of the meal.”

Why etiquette?

Kathie Schultz, a 1978 CSU graduate who spent time working in public accounting, helped fund the etiquette dinner. She wanted to give back, her employer wanted to match her personal donation to the Department of Accounting, and she wanted to find a unique way to contribute to today’s students.

During her time at CSU, she says, she got to participate in an accounting banquet with some similar elements. “Even if there were just a few tips here and there,” Schultz says, “each thing I learned was one less thing I had to worry about when I later went into business dinners. I was much more at ease, and knew how to make others feel at ease, too. So I could concentrate on whatever business we needed to talk about.”

Hornback’s training gives students the ability to understand how to confidently navigate not just a five-course dinner, but anything from a casual dining setting, to a 14-course meal in Japan.

Carli Judson, a junior double-majoring in accounting and finance, said she was very grateful for the opportunity. “I learned so much,” she says, “including the order in which drinks are served, and in what glasses; how to politely refuse drinks; what each utensil is for; and how to politely eat a roll — which is way more complicated than you’d think! It was very important to learn all these things while doing them. I don't think I could have effectively understood or remembered most things otherwise.”

Schultz hopes the dinners can continue in future years, she says. “I’m a very lucky girl to have gone to school at CSU… I can’t thank Audrey Gramling enough for being so open to discussing different ideas for things people want to do for those studying there today. It really makes you want to stand up and pay it forward.”

Etiquette Tip for Used Silverware

Marie Hornback says you should never put used silverware back on the table between courses, if servers don’t remove them with your dishes. Not so much because it would bother anyone else — but because you won’t want to use the silverware again if you do let it touch the table. If your main plate is gone and you’re waiting for your next course, here are some polite and sanitary options:

- Turn your fork upside down and place the tines on an unused knife if you have one

- Place it on your small bread plate if it’s still in front of you

- Set it on a napkin or other paper product left on the table

Student Focus: Two Accounting Seniors Selected for Prestigious KPMG Program

This year marks the first time that students across the country will have an opportunity to join an elite Master’s degree program offered in part by KPMG. The Master of Accounting with Data and Analytics Program is taking just 52 students from all over the U.S. — with two of them being current Colorado State University Department of Accounting students.

With tuition, room, and board all paid by the program, these Master’s students will first attend fall classes at The Ohio State University or Villanova University where they’ll have access to KPMG technology for their studies. Then, they’ll intern at a KPMG office for the spring semester. After the Master of Accounting program concludes in the summer, the new graduates will return to KPMG to work full-time.

Preparing for Long-term Careers

[caption id="attachment_57979" align="alignleft" width="200"] Jackson Wojciechowski, Department of Accounting Student, '17[/caption]

Jackson Wojciechowski and Parker Duda, the CSU Department of Accounting students who were chosen for the program, say they’re excited for the unique opportunity. Both will be at The Ohio State University for the classroom portion of the program.

“I think all the participants are going to leave the Program prepared for the data age,” says Wojciechowski. “We will be given incredible resources from the universities, KPMG, and each other.” He notes that in Instructor Beth Dixon’s class, he was assigned to read an article about how automation is affecting the accounting profession.

He says the article initially made him a bit concerned about his future job security. But when he learned about the KPMG opportunity, he says, “I felt confident that this would be a way to stay ahead of the curve, and stay competitive among my peers. Additionally, I think adding data and analytics into the auditing profession opens the opportunity to see much safer and better structured capital markets.” He believes the added training will put him at the forefront of the industry.

[caption id="attachment_57980" align="alignleft" width="200"]

Jackson Wojciechowski, Department of Accounting Student, '17[/caption]

Jackson Wojciechowski and Parker Duda, the CSU Department of Accounting students who were chosen for the program, say they’re excited for the unique opportunity. Both will be at The Ohio State University for the classroom portion of the program.

“I think all the participants are going to leave the Program prepared for the data age,” says Wojciechowski. “We will be given incredible resources from the universities, KPMG, and each other.” He notes that in Instructor Beth Dixon’s class, he was assigned to read an article about how automation is affecting the accounting profession.

He says the article initially made him a bit concerned about his future job security. But when he learned about the KPMG opportunity, he says, “I felt confident that this would be a way to stay ahead of the curve, and stay competitive among my peers. Additionally, I think adding data and analytics into the auditing profession opens the opportunity to see much safer and better structured capital markets.” He believes the added training will put him at the forefront of the industry.

[caption id="attachment_57980" align="alignleft" width="200"] Parker Duda, Department of Accounting Student, '17[/caption]

Duda agrees, saying he anticipates the program will help him better serve his future clients, and his future KPMG colleagues. “With the business world continuously integrating the technology industry,” he says, “the opportunity to become accustomed with new data tools and software is going to give me the base I need in order to successfully grow in the accounting field.”

Duda says he wasn’t originally sure that he wanted to go on to any graduate studies, but the KPMG Master of Accounting program swayed him. “What really sold me was the idea of getting an extra level of preparation before starting to work full time,” he says. “With KPMG providing so many resources for us students to acquire additional knowledge and experience, I knew that this program would be extremely beneficial.”

Expanding on CSU Training

Wojciechowski and Duda both say they look forward to taking their CSU training to the next level as they complete preparations to work at KPMG. “At CSU, there are so many opportunities to become involved in various programs, and attain leadership positions,” says Duda, who notes that his leadership roles with the tennis club and sport clubs likely helped give him an edge when he applied for the KPMG program.

“Additionally,” Duda says, “the College of Business, and more specifically, the accounting professors, provided all the support I needed to be successful in my studies. The accounting professors show genuine interest in each student and attribute to the confidence we need in order to progress.”

Wojciechowski echoes the sentiment saying, “I really would like to thank the College of Business, the Accounting Program at CSU, and of course, KPMG for guiding me and helping direct me to be the best version of myself. I'm extremely excited for the future, and feel unbelievably thankful that KPMG has already invested so much of their time and resources to my future.”

Please join us in congratulating them on being part of the inaugural class of the KPMG Master of Accounting with Data and Analytics Program – and wishing both of the them much success as they take this next step, after they graduate this May.

Parker Duda, Department of Accounting Student, '17[/caption]

Duda agrees, saying he anticipates the program will help him better serve his future clients, and his future KPMG colleagues. “With the business world continuously integrating the technology industry,” he says, “the opportunity to become accustomed with new data tools and software is going to give me the base I need in order to successfully grow in the accounting field.”

Duda says he wasn’t originally sure that he wanted to go on to any graduate studies, but the KPMG Master of Accounting program swayed him. “What really sold me was the idea of getting an extra level of preparation before starting to work full time,” he says. “With KPMG providing so many resources for us students to acquire additional knowledge and experience, I knew that this program would be extremely beneficial.”

Expanding on CSU Training

Wojciechowski and Duda both say they look forward to taking their CSU training to the next level as they complete preparations to work at KPMG. “At CSU, there are so many opportunities to become involved in various programs, and attain leadership positions,” says Duda, who notes that his leadership roles with the tennis club and sport clubs likely helped give him an edge when he applied for the KPMG program.

“Additionally,” Duda says, “the College of Business, and more specifically, the accounting professors, provided all the support I needed to be successful in my studies. The accounting professors show genuine interest in each student and attribute to the confidence we need in order to progress.”

Wojciechowski echoes the sentiment saying, “I really would like to thank the College of Business, the Accounting Program at CSU, and of course, KPMG for guiding me and helping direct me to be the best version of myself. I'm extremely excited for the future, and feel unbelievably thankful that KPMG has already invested so much of their time and resources to my future.”

Please join us in congratulating them on being part of the inaugural class of the KPMG Master of Accounting with Data and Analytics Program – and wishing both of the them much success as they take this next step, after they graduate this May.